How to Set Up a Business Bank Account That Supports Contracting Success

Most small businesses preparing for government contracts focus on the big three: licenses, certifications, and vendor registrations. But here’s the quiet truth: your business bank account is just as crucial. It's not just a place for deposits—it's your foundation for financial readiness, credibility, and compliance.

Whether you’re wiring funds to suppliers or submitting proof of financial capacity to a city agency, the correct banking setup shows you’re serious, organized, and ready to perform.

Step 1: The Non-Negotiable Rule: Separate Your Finances

Your business bank account is the single most important tool for financial compliance in government contracting. Why? Because public agencies demand clear, auditable records that prove your business's financial health is separate from your personal life. To succeed in contracting and maintain liability protection, you must use a dedicated business bank account regardless of your legal structure. This essential separation is the foundation for preserving liability protection, building credit, and earning the distinct financial records required for certifications and bids.

One of my former clients, a transportation company in Long Beach, initially approached me for assistance getting SBE/DBE certified. During my review of her preliminary submission documents, I quickly identified that her personal and business transactions were mixed, despite her existing corporate structure. This commingling meant she couldn't produce the clear, dedicated financial records required to satisfy the financial capacity review. This failure to demonstrate clean financial discipline is a common issue for many small subcontractors.

As a first step, I advised her to consult with an accountant to help her correct past accounting issues and ensure the proper distinction between business and personal funds going forward. Once she opened a dedicated business bank account and began tracking expenses separately, she was able to produce clear, auditable records—and within six months, qualified for and won a small contract through the City of Torrance.

Pro Tip: Always confirm your business structure and registration requirements with an accountant, attorney, or another qualified advisor before making changes.

Step 2: Choose a Bank That Understands Small Contractors

Once your structure is formalized, the next critical step is finding the right financial partner. Not all banks offer the same level of support for subcontractors. Some focus mainly on consumer accounts, while others are equipped to handle the needs of small and micro-businesses that work on public contracts.

When comparing banks, focus less on brand names and more on the features and responsiveness that matter most to your operations. A good fit can mean the difference between smooth cash flow and delayed payments when deadlines are tight.

Use this quick checklist when evaluating your banking options:

✅ Fee Structure: What are the monthly fees, and how can they be waived (e.g., by maintaining a minimum balance)?

✅ Transaction Limits: How many free deposits or withdrawals are included before you’re charged fees? This is crucial for subcontractors who handle frequent payments or supplier invoices.

✅ Lending Specialization: Do they offer SBA-backed or working capital loans for contractors?

✅ Cash Management Tools: Do they provide features like Remote Deposit Capture (RDC), ACH payments, and wire transfer services that simplify payments to vendors and employees?

✅ Local Presence: Are there nearby branches or commercial banking offices for in-person issues, large cash deposits, or notary needs?

✅ Account Type: Do they offer analyzed checking accounts—where earnings credits offset monthly fees—if your business keeps higher balances?

Compare banks using a checklist that focuses on what truly matters: fees, lending support, cash-management tools, and local access.

Step 3: Use Multiple Accounts to Manage Funds Responsibly

Regardless of how many accounts you have, the most important rule of financial discipline is visibility. Some small businesses find it helpful to maintain separate accounts to improve visibility and reduce confusion during audits or project reviews.

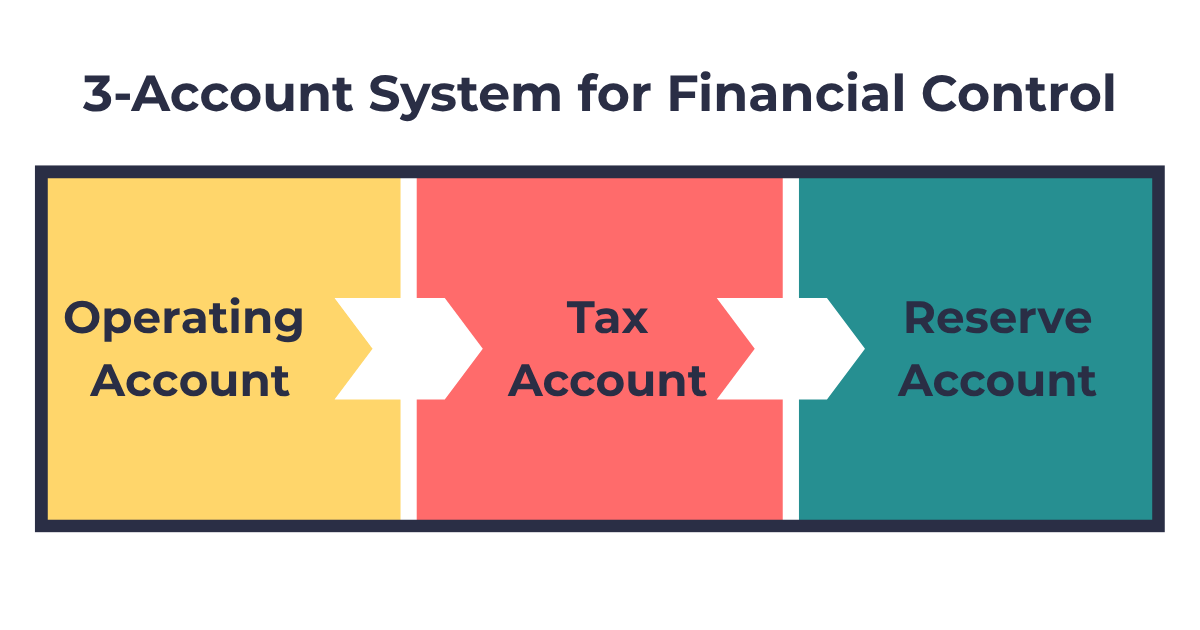

Consider discussing a multi-account structure with your accountant, which could include:

Operating Account: For day-to-day expenses and project costs.

Tax Account: To set aside estimated tax funds throughout the year.

Reserve or Retention Account: To hold funds until project completion or agency release.

One of my clients, a roofer in Los Angeles, was struggling to stay current on his tax payments. I advised him to work with his CPA to set up a payment plan, which he began following. However, after missing a single payment, the tax authority withdrew the entire outstanding balance directly from his main checking account. The sudden withdrawal jeopardized his payroll and delayed material purchases, causing him significant stress.

After adopting my three-account system, he began meeting his tax obligations consistently. In less than a year, he demonstrated his financial discipline during a prequalification review with a major contractor. A reserve account can also help professional services firms manage slow payment cycles between projects.

The three-account system — operating, tax, and reserve — helps small businesses maintain visibility, control cash flow, and stay compliant.

Step 4: Keep Business and Personal Transactions Separate

This may sound basic, but combining personal and business funds—even occasionally—can create accounting confusion, reduce transparency, and complicate financial reviews. This is one of the most common issues I see among small subcontractors.

Some certification or prequalification applications may require recent business bank statements—especially when financial capacity is part of the eligibility review. Having a clear, dedicated business account helps ensure those records are organized and easy to provide if requested.

If you need to transfer funds between personal and business accounts, always seek guidance from your accountant or bookkeeper. They can advise on the correct classification to maintain clear, auditable records.

Step 5: Use the Account Strategically to Build History

Once your dedicated business account is open, use it to create a reliable financial history that supports future growth and stability. This history can be crucial when applying for project financing, lines of credit, or demonstrating capital requirements for larger bids.

Consult with your financial advisor or accountant to discuss how to best use your new account(s) to:

Establish a Credit Profile: Explore options for establishing a distinct credit profile for your business, separate from your personal credit.

Document Payment Consistency: Systematically document recurring business expenses to build a track record of reliable payments.

Integrate Records: Link your business account to your accounting software to automate transaction tracking and streamline the financial review process.

A Santa Ana-based catering company I once advised began doing this to qualify for a small line of credit. Within eight months of disciplined use, she secured a $15,000 credit line—enough to cover upfront supplies on a project with net-60 billing. Having that kind of cushion can make a difference between accepting or declining new opportunities.

Step 6: Keep Banking Records Audit-Ready

Government contracting often involves documentation reviews—and sometimes audits after a project is completed. Maintaining clear banking records helps make those reviews faster and far less stressful.

Many small businesses find success by:

Reconciling accounts monthly.

Saving digital copies of checks, deposits, and invoices by project.

Clearly labeling transfers (e.g., “Tax Transfer – Q1”).

Storing monthly statements in a secure digital filing system.

These habits can save hours—and potentially prevent costly delays—during compliance reviews by agencies like LA Metro, LAWA, or OCTA.

Clear, labeled records make audits and financial reviews faster, simpler, and stress-free for subcontractors.

Step 7: Review Your Banking Relationship Regularly

As your business evolves, your banking needs might, too. It’s wise to review your accounts annually—perhaps each January or at the start of the fiscal year.

Ask yourself:

Does my bank understand public-agency payment cycles?

Are there better interest or credit options available elsewhere?

Do I have access to financing if I win a larger project?

If the answers suggest a need for change, it may be time to explore additional banking relationships or compare business products at other institutions.

The Bottom Line

A well-managed business bank account supports financial credibility and operational stability. It signals to agencies, primes, and lenders that you have systems in place, can manage cash flow responsibly, and take your role as a subcontractor seriously. While each business is unique, the goal remains the same: to make your financial systems work for you, not against you.

Ready to Strengthen Your Business Foundation?

Setting up your bank account is one key step in being government-ready. Ready to make sure you're not missing any others?

Use my Business Readiness Checklist to identify where your business stands today—and then follow the 7-Day Plan to take immediate, practical steps toward contracting success. Don't risk losing your next bid due to an easily fixed gap.

Download the checklist now, follow the plan, and get your foundation in order this week! Both are available on the Resources page.

Let’s get your house in order—because readiness is your best strategy!

Stephanie

About Stephanie: Stephanie Clark-Ochoa is a Government Procurement Strategist and founder of Clark-Ochoa Business Services. Through Help 4 LA Subs, she provides practical tools and insights to help micro and small businesses in the Greater Los Angeles area become government-ready and thrive in public contracting.

Disclaimer: This post is for informational purposes only and does not constitute legal, financial, or professional advice. Please consult a qualified advisor before making decisions specific to your business.

🔜 Next Week on the Blog: Protect Your Business: Essential Insurance Policies for Small Business Owners

Many subcontractors carry general liability insurance but may miss other vital policies for bidding readiness. Next week, we'll discuss essential coverage types for small business owners, including workers’ comp, auto liability, and errors and omissions. Learn how to avoid common insurance pitfalls, confirm your coverage, and safeguard your business before your next project.